50+ what happens when a mortgage goes to underwriting

In this situation you may contest the appraisal negotiate with. In addition to monthly income.

Ex 99 1

Web Mortgage underwriting is when the lender checks out your financials so they can decide whether or not to extend the loan.

. Web Your closing costs which are 2 to 5 of the loans cost will include the appraisal title search and other fees. The decision In the final step the underwriter will. Web If the home is worth much less than the mortgage your underwriter may suspend your application.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web When you apply for this type of mortgage the underwriter will make sure that your application meets both the lenders standards as well as the standards set forth. Web If everything checks out your application will be approved.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. This process is essential for lenders. Web Underwriting occurs once youve completed your mortgage application and all required documents are turned in for the underwriter to review.

Involving critical examination of the application and the credibility of the applicant an. Web What Happens After my Mortgage Loan is Underwritten. Once your loan goes through underwriting youll either receive final approval and be clear to close be.

Web A mortgage underwriter works for a mortgage lender. Web Mortgage underwriting is a necessary step in the mortgage origination process and begins when the seller accepts the offer you submitted to purchase a home. Once your underwriter has thoroughly reviewed your application they then decide on what.

Web The last stage of the underwriting process is the decision. Web Mortgage underwriting is a complicated and time-consuming process. Your lender will conduct a final review double-checking to.

Web The underwriter could approve deny or suspend your application based on their assessment of your creditworthiness. However if the underwriter determines that lending to you could be a risk or the property is insufficient. In mortgage underwriting you can imagine with 100000s involved the risk can get high really quickly so the.

Someone called a mortgage. Web Once your mortgage underwriter has signed off on the loan there are just a few more hurdles to clear. Web The underwriter compares your debts to your income to verify you have enough income to afford your monthly mortgage payments taxes insurance.

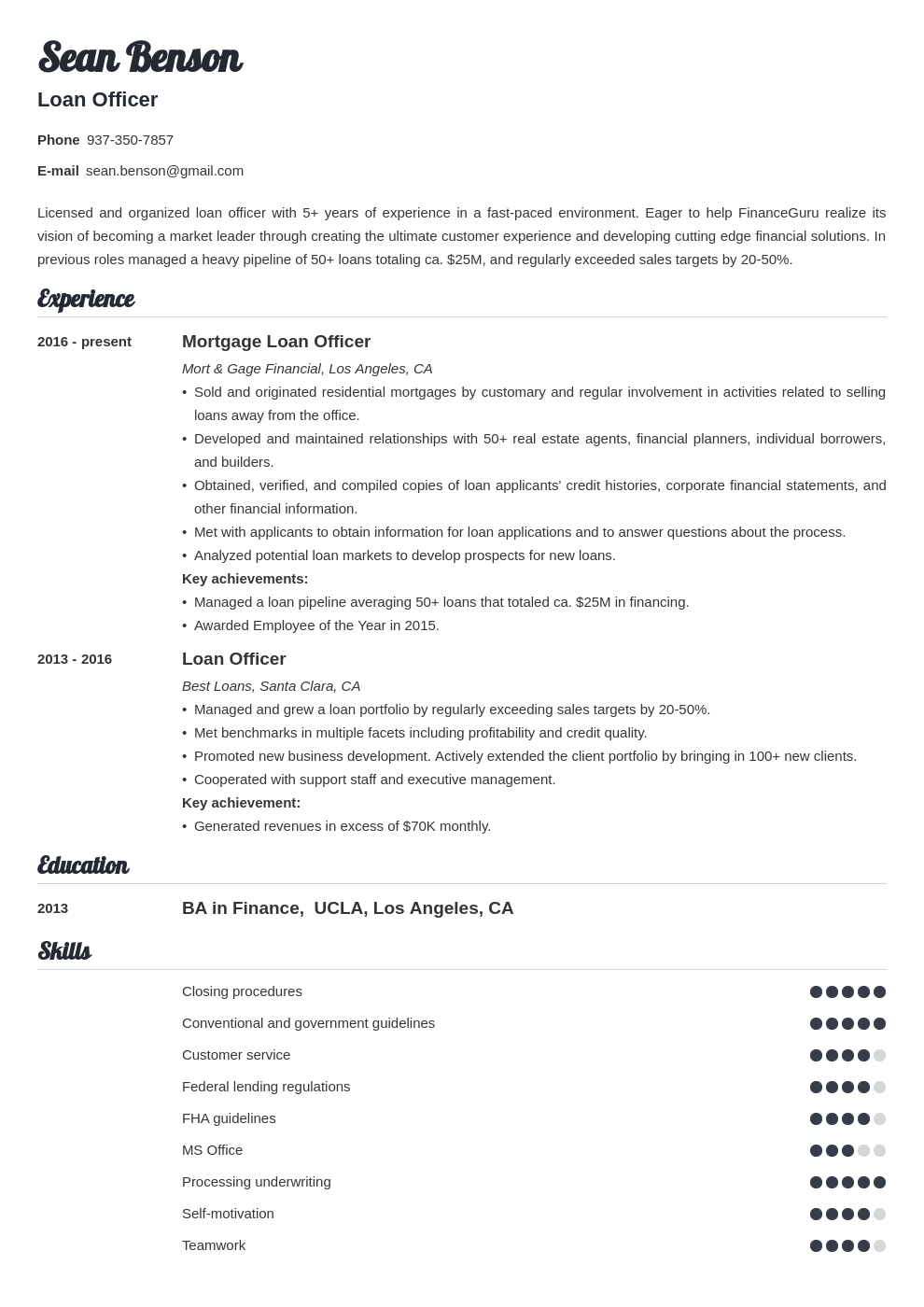

Loan Officer Resume Sample With Job Description Skills

Financial Stability Review May 2019

Digital Marketing Services For Mortgage Brokers Lenders Banks And Credit Unions

Mortgage Introducer September 2022 By Key Media Issuu

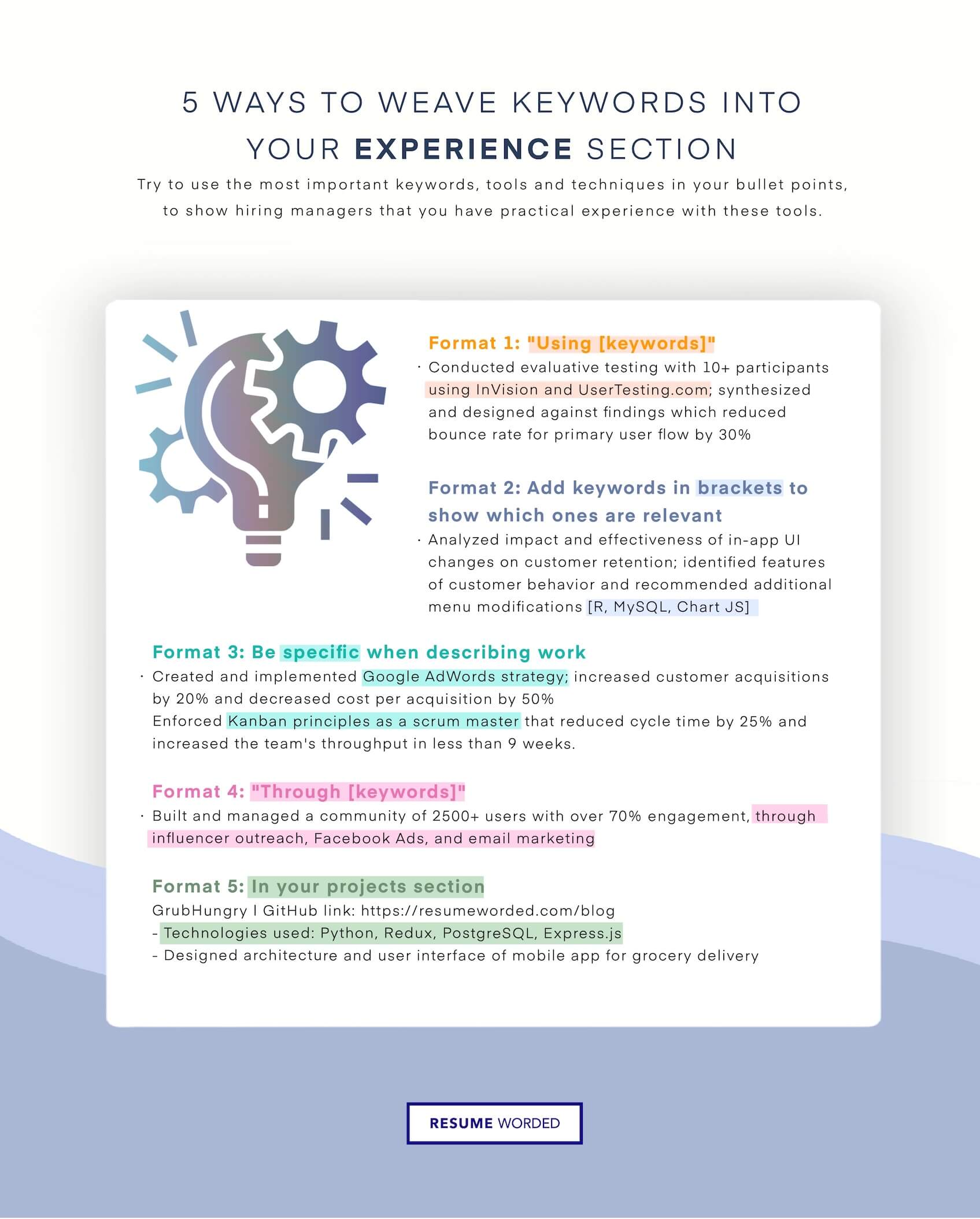

Resume Skills And Keywords For Mortgage Underwriter Updated For 2023

How Can Blockchain Transform The Mortgage Industry Part 40 By Techskill Brew Blockchain 101 By Techskill Brew Medium

Digital Mortgage 2017 National Mortgage News Conferences

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

Is Underwriting The Last Step In The Mortgage Process

How Long Does Underwriting Take Is No News Good News

Predictive Modeling In Underwriting

Carol Deponio Resume

Home Loans And Refinance Movement Mortgage

How Does The Mortgage Underwriting Process Work Greater Lansing Mls

Guide To Loan Fraud Business Risks For Lending Seon

Resume Skills And Keywords For Mortgage Underwriter Updated For 2023

Social Media Credit Scoring How It Works Pros Cons Seon